Blog

Getting Ready for Single Touch Payroll Phase 2 Implementation

Are you ready for STP Phase 2? How do you know if you are using STP Phase 2? Single Touch Payroll Phase 2 streamlines reporting information about your employees to government agencies. Our assistance will give you peace of mind that your payroll software is correctly set up for STP Phase 2.

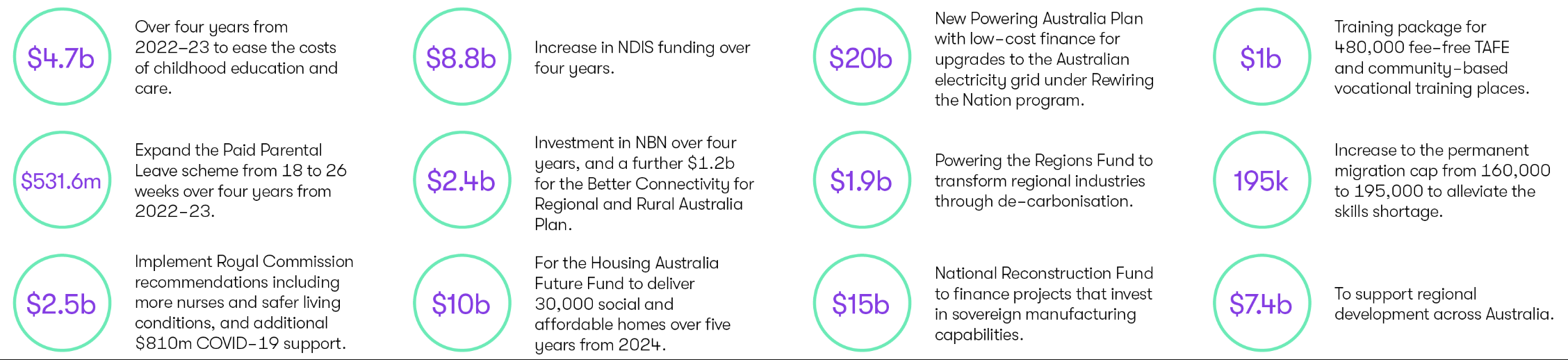

How The 2022-23 Federal Budget Affects Your Business

Get better understanding about the 2022-23 Federal Budget from our tax experts! Here’s the breakdown of the key elements discussed in the announcement and see what this means for you and your business.

Rental Property Tax Deductions That Landlords Should Not Claim

Experts advised landlords to keep sufficient and correct records of their taxes. Here’s why you should keep sufficient records of your taxes and rental income and be careful not to overstate deductions.

2022 YEAR END TAX TIPS AND REMINDERS

Make sure you keep up to date with everything tax related that affects you. Here's the 2022 End of Financial Year Reminders and Action Items. Some of these will help to minimise your tax. Others will reduce your exposure to an ATO tax audit.

2022 SMSF YEAR END TAX TIPS + REMINDERS

The tax and superannuation laws are always changing, and we are here to help you stay informed. As a Trustee / Director of a Trustee Company for your Self Managed Superannuation Fund (SMSF), you need to be aware of key changes each year and opportunities and risk areas. Some of these reminders will help to […]

Get ready for a brutal Federal Budget and ATO Trust S100A initial guidance

The Australian Taxation Office will release a preliminary guidance on Section 100A in the next two weeks. The upcoming 2022 October Federal Budget will be a tightening one and it could be very brutal! Contact us today to help you prepare for ATO Trust S100A.

ATO Announces Four Areas of Focus for Taxation This Year

The Australian Taxation Office has uncovered four key areas to focus on as businesses prepare for their tax this year. Being aware that many Aussies are engaging with cryptocurrencies or digital assets, the tax office said that crypto investors will be one of their priorities at tax time.

Liberal Party’s Super Home Buyer Scheme vs Labour Housing Policy for the Young

Liberal Party announces new Super Home Buyer Scheme to help first-time home buyers unlock their super to get into the property market more quickly. On the other hand, Labor’s Help to Buy housing policy will assist those people on a lower income who are not able to buy a house.

5-STEP BUSINESS PLAN TO HELP YOU SUCCEED

We have a unique 5-step business plan that we can customise for you to give you peace of mind. We make sure that your financial affairs are cared for in the best manner possible so you can live your best life!

5 REASONS TO UPDATE YOUR FAMILY DISCRETIONARY TRUST DEED

Why do you need to update your family and discretionary trust deeds? Whenever you set up your discretionary trust, it was for a particular reason. This may be for asset protection, tax reduction or for building family wealth. In any case, similar to a cell phone, popular features must be upgraded. This something very similar […]

The Winners and Losers in the 2022 Victorian Budget

Emergency services is the major focus in the 2022-23 election-year Victorian budget. Contact us today at Success Accounting Group to help you navigating the implications and opportunities of this Budget for you and your business. Book in your Tax Planning now with less than 50 days left before the EOFY.

Superannuation Death Benefits – Who Gets Your Super?

Who decides what happens to your superannuation savings when you die? You might believe that you do, however that isn't generally the situation. A definitive choice might be made by somebody you don't know - the legal administrator or trustee of your superannuation fund. Here’s what you need to know in making a valid binding death benefit nomination.