General Accounting

What every employer needs to know about fringe benefits

On 31 March 2020, the Fringe Benefits Tax (FBT) year ends. With the ever increasing budget deficits, the ATO will be reviewing whether all employers who should be paying FBT are, and that they are paying the right amount. To help you meet your fringe benefits obligations, we’ve put together a list of essentials every […]

The Second $66.1 bn Stimulus Package: What You Need To Know

The Government yesterday released a second, far reaching $66.1 bn stimulus package that boosts income support payments, introduces targeted changes to the superannuation rules, provides cash flow support of up to $100,000 for small business employers, and relaxes corporate insolvency laws. The stimulus measures are not yet legislated. Parliament will reconvene on Monday 23 March. […]

The Stimulus Package: What You Need To Know

The Government has announced a $17.6 billion investment package to support the economy as we brace for the impact of the coronavirus. The yet to be legislated four part package focuses on business investment, sustaining employers and driving cash into the economy. For business Business investment Increase and extension of the instant asset write-off Accelerated […]

Gain an additional $4000 return in TAX or receive a FREE IPAD

With EOF Year upon us, what sort of emotion does this spark in you?Feeling that slight jitter in the stomach. Touch of anxiety. Restlessness.Do you put it off to the last minute, then spend a few days cramming to get it done?No one likes Tax. We then head in, speak to an Accountant , push out […]

The Secret Truth On How The Top 1% Achieve Their Goals

Today I felt inspired to write a small passage based on a vibrant consultation I held with one of my inner circle clients. My client Greg was having some real difficulties around goal setting. This is normally the first exercise I perform with my one-on-one clients to assist them in achieving financial independance.I asked […]

5 Warning Signs That You Have Slipped From The Path To Wealth

Let me share a story with you… It was a little over 12 years ago when my whole life flashed right in front of me. My family was in a state of collapse. I was working over 12 hours a day and was completely run-down. My back was against the wall and I was completely […]

Secrets To Why The Rich Get Richer

95% of Australia’s population at age 65 is either dead, dead broke or on the pension. This is not discriminatory. This includes Tradies, Engineers, IT Consultants, Doctors, Lawyers, School teachers, Secretaries, Accountants and so on. How can this be possible? The Australian Government pumps Billions of dollars in education from school days to retirement and […]

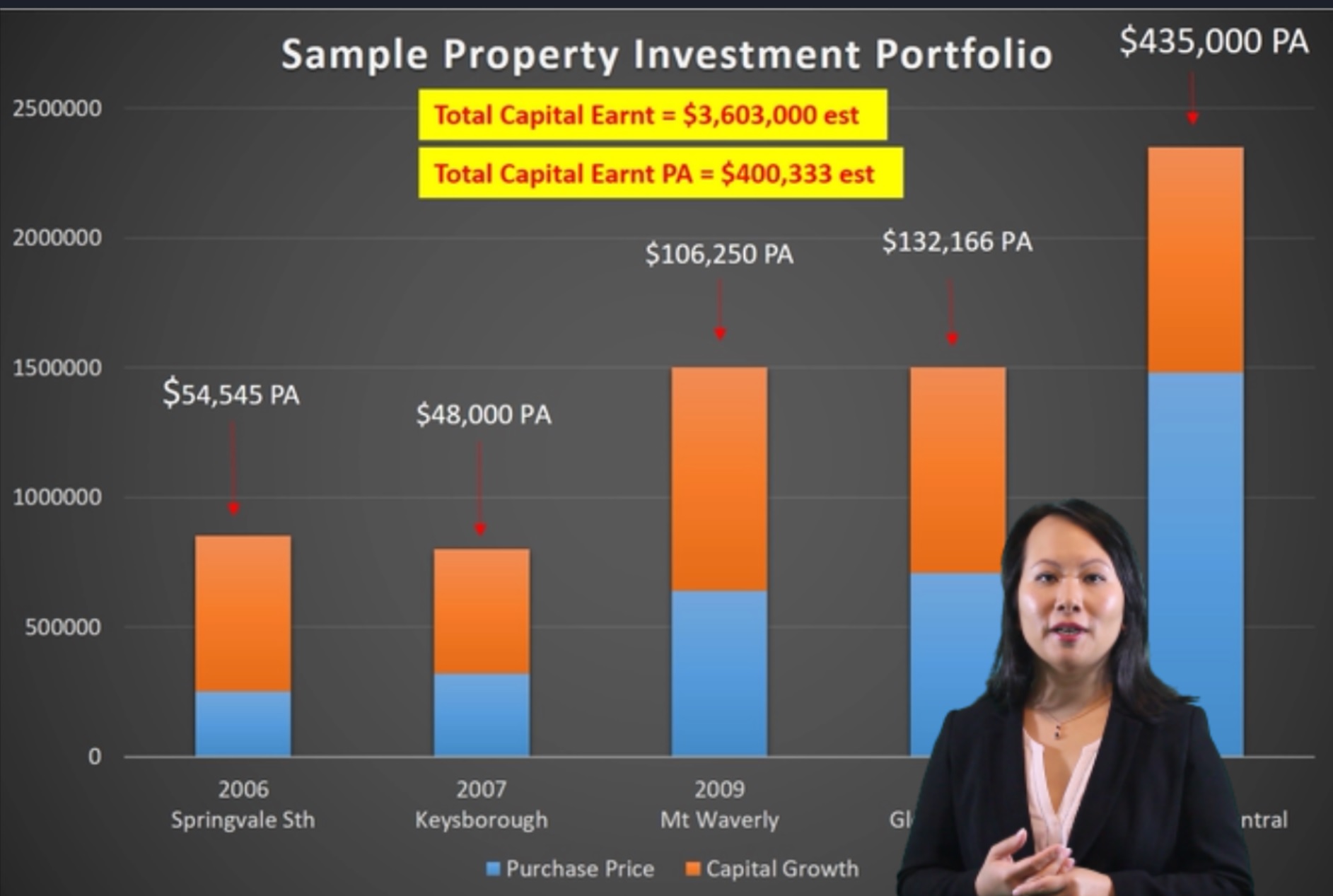

Turn $1 into $1 million dollars in five years

Today I am going share my biggest Secret towards creating wealth. It is Leverage! Leverege for me is turning $1 into $1 million dollars in five years! There is three main vehicles you can use to create leverage: Real Estate Equities Businesses For my own personal story, I started in Real Estate as it was […]

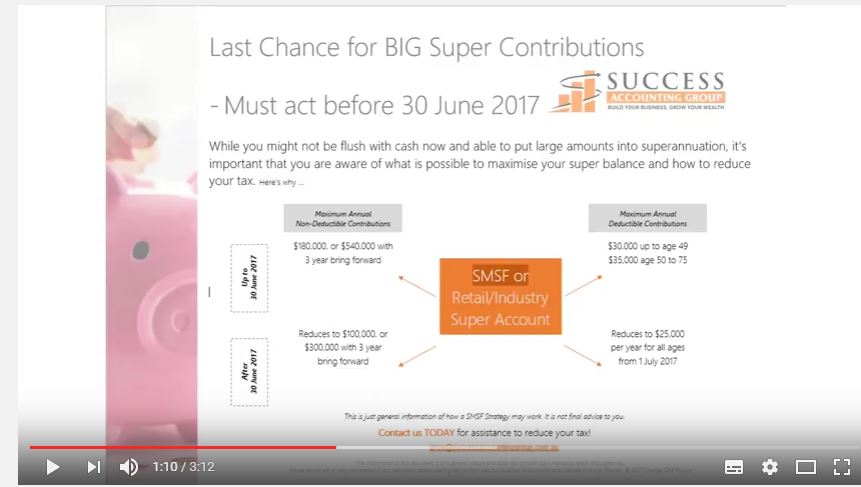

last chance for big super contributions

last chance for big super contributions This is your last chance for super contributions before 30th June 2017, because of vastly reduced allowed amount that you can put into your superannuation. Thus, decision is vital before 30th June, so that you can maximise the amount of your super. This is possible by using two […]