Bah humbug: The Christmas Tax Dilemma for Businesses

Don’t want to pay taxes during the holidays? Here are our top ideas to avoid giving ATO a bonus for this holiday season.

5 Tax Saving Tips During Christmas Time

Don’t let taxes ruin your holiday spirit! This blog explains the tax complexities of Christmas spending, ranging from FBT on parties to gift deductions.

1. Maintain the spontaneity of team gifts.

$300 is the small benefit threshold for FBT. Any amount at or above this level will result in a gift to the ATO at a rate of 47%. Gifts must also be ad hoc to qualify as a modest benefit – no monthly gym subscriptions or giving a person multiple gift cards totaling $300 or more.

Cash gifts from the business are recognised as salary and earnings, triggering PAYG withholding and subjecting the amount to the superannuation guarantee.

Apart from the tax implications, consider what will be useful to your staff. The most meaningful present is one that means something to the recipient. Giving a bottle of wine to someone who doesn’t drink, chocolates to a health nut, or time off to someone who has too much time off won’t earn you many friends. A genuine personal message is often more effective than a generic present.

2. The FBT Christmas party rush

If you really want to avoid paying taxes on your office Christmas party, hold it on a workday. As a result, regardless of how much you spend per person, Fringe Benefits Tax (FBT) is unlikely to apply. Taxi travel that begins or ends at an employee’s workplace is also free from FBT. So, if you have a few team members who need to be put into a cab after overindulging in holiday happiness, the ride home is tax-free.

If your company’s Christmas party is held outside the office, limit the cost of your celebrations under $300 per participant to avoid paying FBT. The disadvantage is that if there is no FBT payable in respect to the party, the company cannot claim deductions or GST credits for the expenses.

If the party is hosted somewhere other than your office, the cab ride is considered a separate benefit from the party and any Christmas gifts you have supplied. In theory, if the cost of each item per person is less than $300, the gift, party, and taxi journey can all be FBT-free. Just keep in mind that the minor benefits exemption is dependent on a variety of circumstances, including the overall value of linked benefits delivered during the FBT year.

If you give entertainment to employees and an FBT exemption exists, you cannot claim tax deductions or GST credits for the expenses.

If your company throws somewhat more elaborate events and exceeds the $300 per person minor benefit limit, you will have to pay FBT, but you can also claim a tax deduction and GST credits for the event’s cost. Just keep in mind that deductions are solely relevant for tax purposes. If your company pays no or little tax, a tax deduction will not assist you cover the expense of the party.

3. Avoid client meals and instead give a present

The most effective technique of spreading Christmas cheer with clients is not often the most tax efficient. If you take your client out or entertain them in any way, it is not tax deductible and you cannot claim GST back. There are special provisions in place to prevent deductions and GST credits from being claimed when the expenses relate to entertainment, regardless of whether goodwill and greater business sales are expected. Restaurants, a show, golf, and corporate race days are all examples of ‘entertainment’.

Nevertheless, if you give a present to a customer, the gift is tax deductible as long as there is an expectation that the business will benefit (provided the gift is not for amusement purposes). Even better, why not personally deliver the gift to your greatest customers and wish them a Merry Christmas? Even if they are not available and the receptionist informs them that you sent the gift, it will have a far greater impact.

If your marketing budget is limited, it is best to focus on the consumers you believe will provide the most value to your company rather than spending a tiny amount on every customer regardless of value. If you’re going to spend money on Christmas gifts, make them memorable and relevant to your company.

You could also make a donation on behalf of your customers (where your company gets the tax break) or for your customers (where they get the break).

4. Charities love cash

Charities love money. Unlike many charity dinners, auctions, and advertising initiatives, they do not have to invest any of their valuable resources to obtain it. And, from a tax standpoint, it’s the most secure approach to assure that you or your company can claim a deduction for the entire amount of the donation.

There are a few regulations to follow when donating to charities that determine whether or not you will obtain a tax deduction.

The charitable organisation must be a deductible gift recipient (DGR). The list of DGRs is available on the Australian Business Register (use the advanced search).

If you buy something for the ‘contribution’ – biscuits, teddies, balls, or something at an auction – it is often not deductible. Your gift should be a gift, not a trade for something material. Purchasing a goat or sponsoring a child’s education in the third world is generally acceptable because you are providing an amount equal to the purpose rather than directly funding that thing.

The individual or business who made the gift and whose name is on the receipt receives the tax deduction for charitable contributions more than $2.

5. Bonuses for the Holidays

If you intend to give your staff a cash bonus rather than a gift voucher or other item of property, keep in mind that it will be taxed in the same manner as income and earnings. A PAYG withholding duty will be triggered, and the ATO believes that the bonus will also be classified as ordinary time earnings (unless it is directly related to overtime work), making it subject to the superannuation guarantee rules.

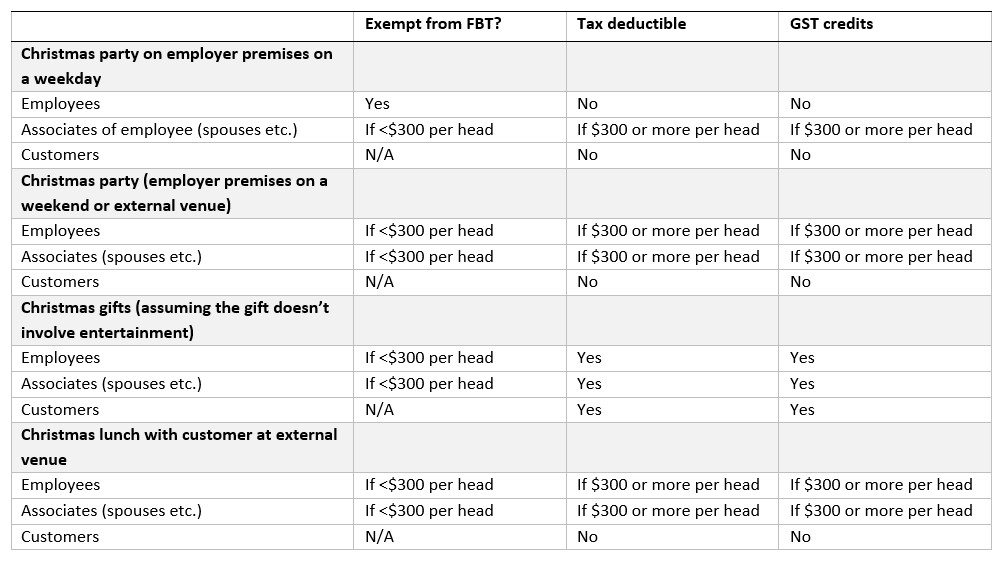

The Christmas Tax Quick Guide

Here’s our quick guide to the tax impact of Christmas celebrations. The information is for GST registered businesses that are not using the 50-50 split method for meal entertainment.

Speak to your advisor today to discover the tax impact of Christmas celebrations on your accounts. Contact us today at Success Accounting Group for professional tax advice.

About Lan Nguyen

Lan is the Founder and Chief Strategist at Success Accounting Group, Melbourne based CA firm. In a matter of short 8 years she has built up a reputable Chartered accounting firm with 3 offices and a team of 6 professional accountants and support team members. Her mission is to provide Innovative and Strategic Financial advice to help her customers make smarter financial decisions today for a brighter future.

Success Accounting Group is for established business owners who would like help to grow a sustained business. As a business owner you understand what drives your business success with our accounting team taking care of the rest.